Description

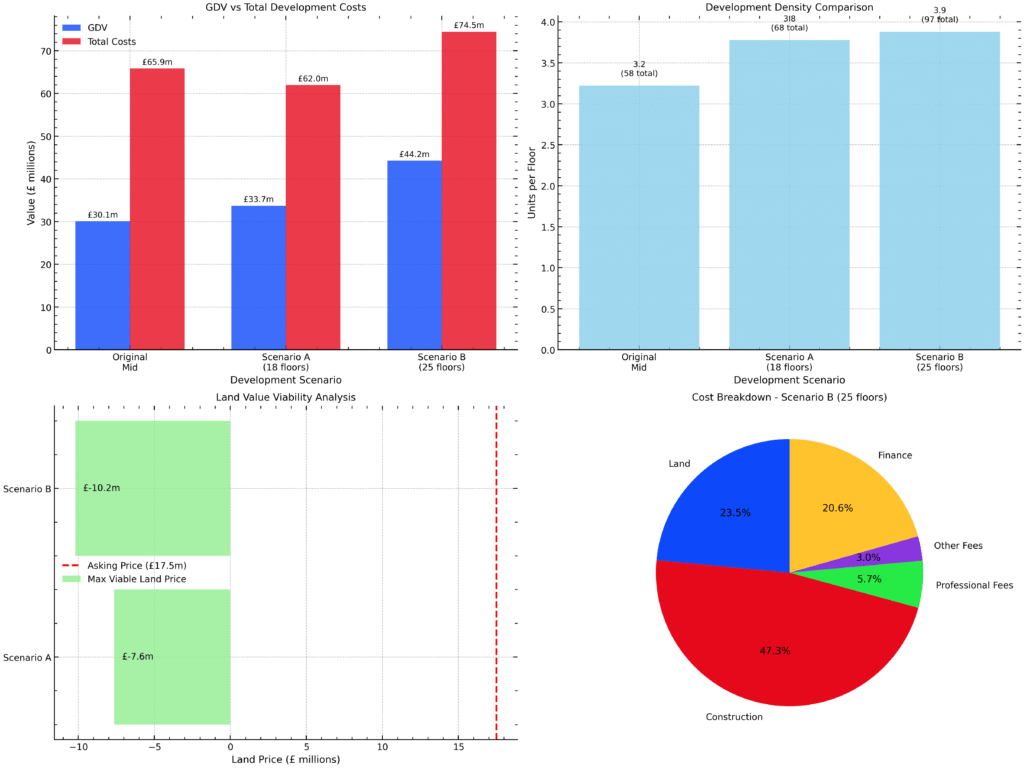

- Key Takeaways: • Freehold bank premises at the corner of Whitechapel Road & Sydney Street, E1 1BJ (c. 21,000 sq ft). • Guide Price: £17.5 million plus fees (subject to planning). Development: 15+ storey mixed-use scheme STP. • Viability: Only a commercial-led approach achieves positive ROI (~15%). • Planning: Tower Hamlets D.DH6 supports tall buildings; nearby Silk District by L&Q/Mount Anvil reaches 26 storeys.

Detailed Description

The Whitechapel development opportunity at 240 Whitechapel Road presents a rare freehold acquisition of a landmark bank premises primed for high-rise transformation. Encompassing approximately 21,000 sq ft across ground and two upper floors, this site invites an ambitious mixed-use tower of 15 or more storeys, in line with Tower Hamlets’ strategic tall building zones under Policy D.DH6. Furthermore, with Crossrail services at Whitechapel Station just minutes away, the location guarantees exceptional connectivity for future occupiers.Conversion opportunity

Current market data shows residential values in E1 ranging from £588–£929 per sq ft. Clustering around £788–£860 per sq ft for modern stock. However, detailed financial modelling reveals that solely residential schemes can be uneconomic at the existing land cost. Instead, a commercial-led mixed-use approach—blending office, retail, and a smaller residential allocation—can deliver up to a 15% ROI, with a Gross Development Value (GDV) of c.£67 million against total costs of c.£58.3 million (profit margin 13.1%). [caption id="attachment_15342" align="alignright" width="1024"] Bank-roi-image[/caption]

Bank-roi-image[/caption]