Description

The Kensington High Street PD opportunity represents a unique, off-market chance. To secure a freehold mixed-use asset in London’s prestigious W8 postcode. Located within walking distance of High Street Kensington station. This property combines established retail income (£105k pa) with immediate upside through a permitted development scheme to convert and extend the upper floors.Permitted development

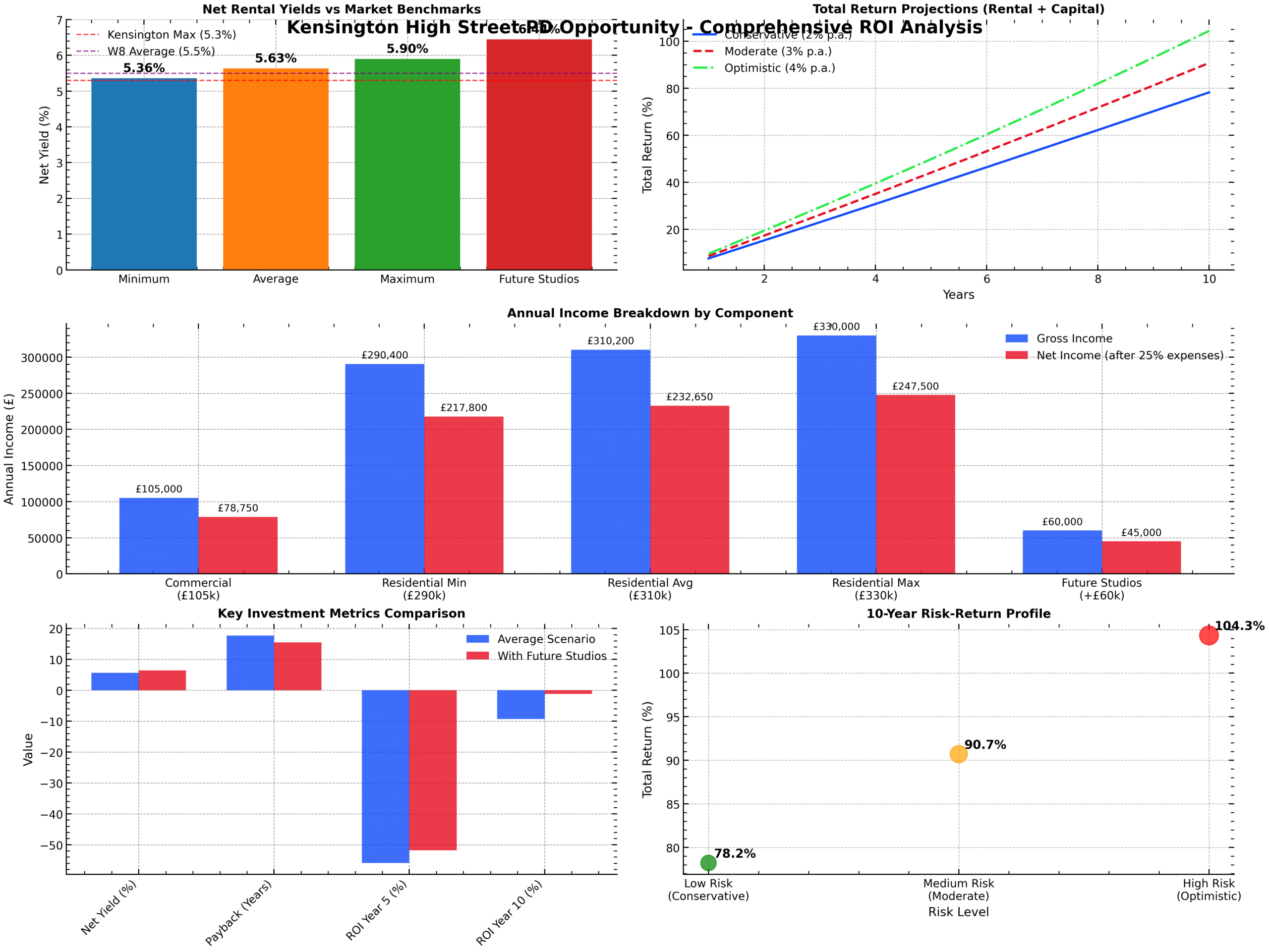

Under the current PD drawings. The existing four flats will be reconfigured into 11 high-specification residential units. Each projected to command rents of £2,200–£2,500 pm on a long-term guaranteed lease. Consequently, the residential income alone is forecast to exceed £300,000 pa. Furthermore, a planning application is in preparation. thereafter, creating two additional studio apartments. Which would lift the total rental roll by approximately £60,000 pa.Investment angle

Investors can acquire the asset at an asking price of £5 million plus fees, with QS-verified refurbishment costs of £530,000. Based on an average combined income of £415,200 pa, this equates to a gross yield of 7.5% and a net yield of 5.6%–6.4% (after standard 25% operating costs), comfortably outperforming the W8 residential average of 5.5%. Moreover, the average price per square foot on Kensington High Street is £1,281, underscoring the value on offer. With no marketing clutter. Viewing is by appointment only This confidential opportunity appeals to investors seeking both immediate income and medium-term capital uplift in a highly liquid Prime Central London market. Investment Insight: Above-market yields vs W8 average Capital value upside as rents grow post-refurbishment Low vacancy risk thanks to guaranteed leases Internal link: Kensington Area Guide

External link: RBKC Planning Portal

Auction Calendar

Listing Updated: 02 August 2025

Internal link: Kensington Area Guide

External link: RBKC Planning Portal

Auction Calendar

Listing Updated: 02 August 2025