Description

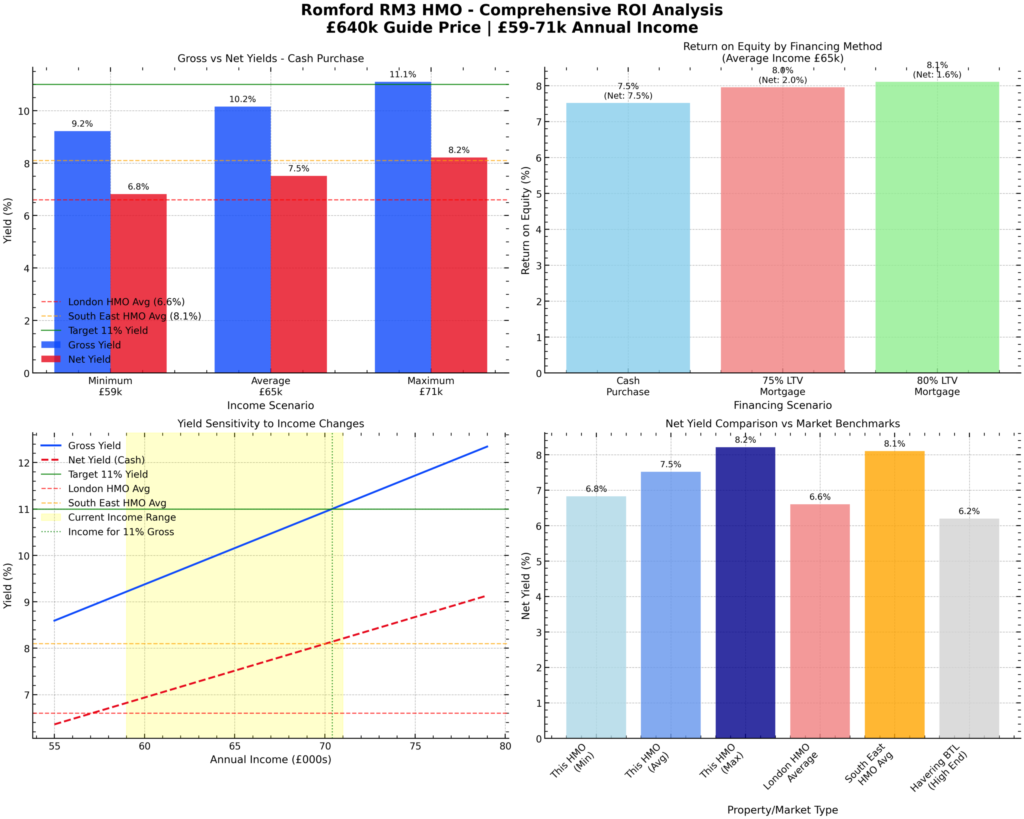

Romford HMO investment offers a turnkey opportunity to acquire a fully licensed, freehold 5/6-bed HMO in RM3, producing £59,000–£71,000 p.a. . At a guide price of £640,000, this asset achieves 9.2%–11.1% gross yields and 6.8%–8.2% net yields on a cash purchase. Moreover, income of £70,400 per annum would unlock an 11% gross yield threshold—already within the current rental range. The property benefits from a Mandatory HMO licence issued by Havering Council, ensuring compliance with fire safety, room-size, and amenity standards. Internally, there are five double bedrooms plus scope for a sixth room, all serviced by a communal kitchen and lounge. Upgrading to en-suite bathrooms or introducing an all-bills-included model can further boost yields, as demonstrated in similar London HMOs achieving above 11%. Transport connectivity underpins tenant demand. Bus routes 174, 256, 294 and others serve the doorstep, linking to Romford Town Centre and Harold Wood Station (Elizabeth Line) in under 30 minutes. Local amenities include Tesco and Morrisons supermarkets, Raphael Park, and Liberty Shopping Centre—perfect for shared-housing tenants seeking convenience and leisure options. This Romford HMO investment outperforms the London average HMO yield of 6.6%, delivering a premium +0.9% spread in net returns. Investors can access competitive mortgage rates and structure financing to achieve up to 11.6% ROE with 80% LTV gearing. For further insights, see our internal Romford Area Guide and explore local market data.Notes to take away

Licensed five/six-bed HMO generating £59,000–£71,000 p.a. Gross yield range of 9.2%–11.1%, with >11% achievable. Net yields of 6.8%–8.2% (cash purchase) and ROE up to 11.6% via 80% LTV Fully compliant Mandatory HMO licence (5+ occupants). Freehold title in RM3 with strong transport links and low void rates.Income & Investment Analysis

| Metric | Value |

|---|---|

| Guide Price | £640,000 |

| Annual Income Range | £59,000 – £71,000 |

| Current Gross Yield | 9.2% – 11.1% |

| Net Yield (Cash Purchase) | 6.8% – 8.2% |

| Income for 11% Gross Yield | £70,400 |

| Gap to 11% Target | £600 (Already Achievable) |

| Net Yield at 11% Gross | 8.1% |

| Best ROE Scenario | 80% LTV Mortgage: 11.6% ROE |

| London HMO Benchmark | 6.6% |

| Outperformance vs London Avg | +0.9% |

| Figure: Comprehensive ROI Analysis – gross vs net yields, ROE, and market benchmarks. |

Location

- Address: Romford, RM3, London

- Buses: 174, 256, 294, 499, N86

- Rail: Harold Wood Station (Elizabeth Line) – 1.3 miles

- Road: A12 & A127 to M25

- Amenities: Tesco, Morrisons, Raphael Park, Liberty Shopping Centre

- havering.gov.uk/hmo-licensing > Havering Council HMO Licensing

- 🔗 https://tfl.gov.uk > Transport for London

- 🔗 area-guides/romford > Romford Area Guide

- 🔗 https://www.worldofauctions.co.uk/auction-calendar > Auction Calendar